Harshad Mehta was once one of the most powerful figures in India’s stock market. He earned the title “Big Bull” due to his bold trading strategies and incredible success. However, behind this success lay a dark secret. Mehta was at the center of one of the biggest financial scams in Indian history.

Mehta’s rise to fame began in the late 1980s. He used his influence to manipulate stock prices and deceive investors. He exploited weaknesses in the banking system to divert large amounts of money into the stock market. This created an artificial surge in stock prices, tricking investors into believing they were in a booming market.

In 1992, the truth came to light. A journalist, Sucheta Dalal, uncovered the scam, revealing how Mehta had siphoned billions of rupees from the banks. The revelation caused the stock market to crash, leading to massive losses for thousands of investors.

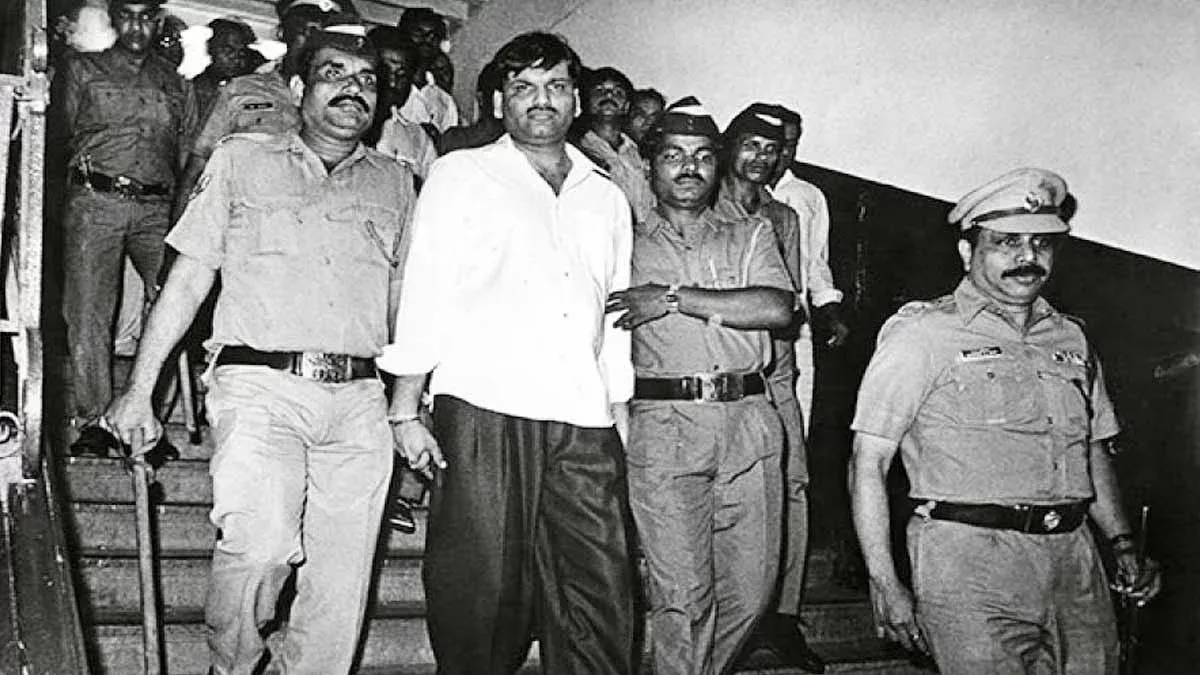

Mehta was arrested and charged with multiple offenses, including fraud and money laundering. His trial lasted for years, but he maintained his innocence until he died in 2001. Despite the scandal, Harshad Mehta remains a controversial figure. Some see him as a visionary who pushed the limits of the market, while others view him as a criminal who destroyed many lives for his gain.

The story of Harshad Mehta continues to captivate India. His life was dramatized in the popular TV series Scam 1992, which reignited public interest in his rise and fall.